Introduction

With the introduction of GST for simplifying the tax payment in various fields, things are expected to become smooth, hassle-free and simple. In order to implement and control the new tax regime, the government has introduced a nodal agency with the mandate of simplifying the tax payments by various stakeholders. In this blog post, we will see what this agency is and what it is mandated with.

GST Network

It is a Section-8, non-Government, private limited company mandated to provide IT infrastructure and services to the Central and State Governments, taxpayers, and other stakeholders for implementing the Goods and Services Tax framework. It is a not-for-profit company with an authorized capital of Rs. 10 crores. The stakeholders of the company are Indian Government, all the States of the Indian Union; including the centrally administered regions of New Delhi and Puducherry; the Empowered Committee of Ministers and non-Government financial institutions. The government has the share of 49% and the private finance agencies the remaining shares in this network. This special vehicle project has adequate safeguards in the form of a government control over its working.

GST Network Features

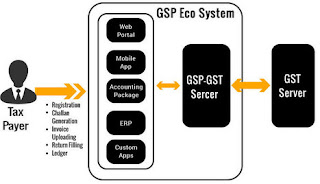

This network is a complex initiative that aims to establish a uniform interface for the taxpayer and a common and shared IT infrastructure between the Center and the States. This bold step will do away the previously followed the Centre and State indirect tax administrations under a variety of laws, regulations, procedures, and formats that totally confuse the people who were under their purview. Hence, the GST Network is designed to integrate this complex indirect tax ecosystem to bring all the tax administrations to the level playing field using this IT platform. Consequently, there will be uniform formats and interfaces for the taxpayers and other external stakeholders. Moreover, it strives to bring in robust settlement mechanism amongst the States and Centre

.

Common GST Portal

This portal will function as the front-end of the overall GST ecosystem of the country. This all important backbone of GST is designed by this special vehicle project. At the back end of this portal are the robust IT systems of CBEC and State Tax Departments. This would enable the smooth handling of tax administration functions, such as registration approval, assessment, adjudication, audit, etc. In connection with this, CBEC and 9 Indian states are developing their own backend systems. This new portal is currently capable of doing the backend functions for 20 States and 5 Union Territories. Prior to the migration of the GST regime, GST Portal was interacting with CBEC and State Tax Departments as a front-end tool on a pilot basis. The issues and shortcomings that were encountered in the trial run have been incorporated and made fool-proof.

Role of GST Portal in Tax Payments

Under GST, the taxpayers have to prepare their own challans for the tax payments through the GST portal only. This mandatory step is expected to weed out the presence of wrong TIN number from the records. Previously, the handwritten entries used to bring in these wrong TINs to the database. Once the registration is complete through the GST portal, the users have two options.

- Online: Through the GST portal, the users have the option of payment through the agency banks that collect the GST. Once the payment is done, the portal generates a paid challan that can be downloaded for the safe custody.

- Offline: In the other option, the user has to take print out of the payment challan and present it to the relevant bank for the Over-the-Counter (OTC) payment. After receiving the money, the bank transfers it to the Reserve Bank of India (RBI) and sends the payment confirmation receipt to GST Portal for accounting purpose.

0 Post a Comment:

Post a Comment